【资料图】

【资料图】

Image source: China Visual

BEIJING, August 11 (TMTPOST) -- SoftBank has sold its shares of KE Holdings Inc., China"s housing service platform, according to its recently disclosed documents,

Based on the market value on May 11, Softbank sold shares worth as much as $2.5 billion. Even against the backdrop of investment institutions reducing their positions of Internet companies, such big sell-off is still unusual.

SoftBank had invested $1.35 billion in Ke"s D+ round of financing in 2019. The prospectus for Beikezhaofang"s U.S. IPO showed SoftBank"s stake at 10.2%, which was reduced to 7.1% in May this year, when the company made its secondary listing on the Hong Kong Stock Exchange. Recently the number was down to zero.

With the downturn in the domestic real estate market and the worsening fundamentals of the brokerage industry in the past year, the platform"s share price has also fallen by more than 80%. Reducing holdings or even liquidating positions partially means that investors have a clear value judgment for the firm.

Following a brief rebound in real estate sales in May-June, the housing market cooled down again in July-August.

Since this year, there have been numerous government stimulus policies, from lowering the down payment ratio and issuing subsidies for home purchases to adjusting the provident fund and lifting purchase restrictions.

Especially in May and June this year, the gradual receding of the impact of the pandemic and the frequent stimulus measures to support the real estate market have significantly improved trading volume.

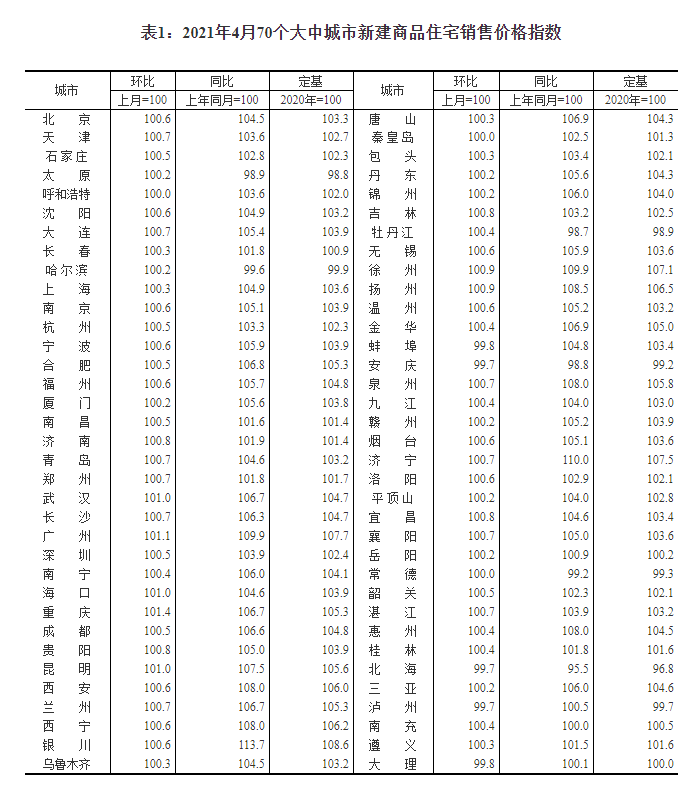

The National Bureau of Statistics data shows that although sales in the first five months declined, commercial housing sales reached 1.05 trillion yuan ($155.3 billion), an increase of 29.7% month-on-month.

KE"s share price rebounded from $7.3/share at the end of March to $19.35/share in June, representing an increase of 165%. As a result, some investors began to expect a revival of the property market, and KE"s performance is expected to recover.